A Post Office Term Deposit Scheme-commonly known as post office FD-is still counted among the most trustworthy saving options in India. In 2025, it continues to be an attractive option among investors owing to its guaranteed returns, government backing, and flexible tenures.

Since the interest rate hence offered is much higher than that offered by a traditional savings account, the scheme is deemed ideal for those investors who seek secured and sure returns without any risks associated with the market.

Interest Rate in 2025

Post Office Term Deposit attracts tenure-based interest rates that vary generally between 6.9% and 7.5% per annum. Investors have their choice between 1-year, 2-year, 3-year, or 5-year deposits. The 5-year TD is most sought after because it also enjoys benefits while claiming for deduction under Section 80C of the Income Tax Act, thus providing twin benefits.

How Returns Are Calculated

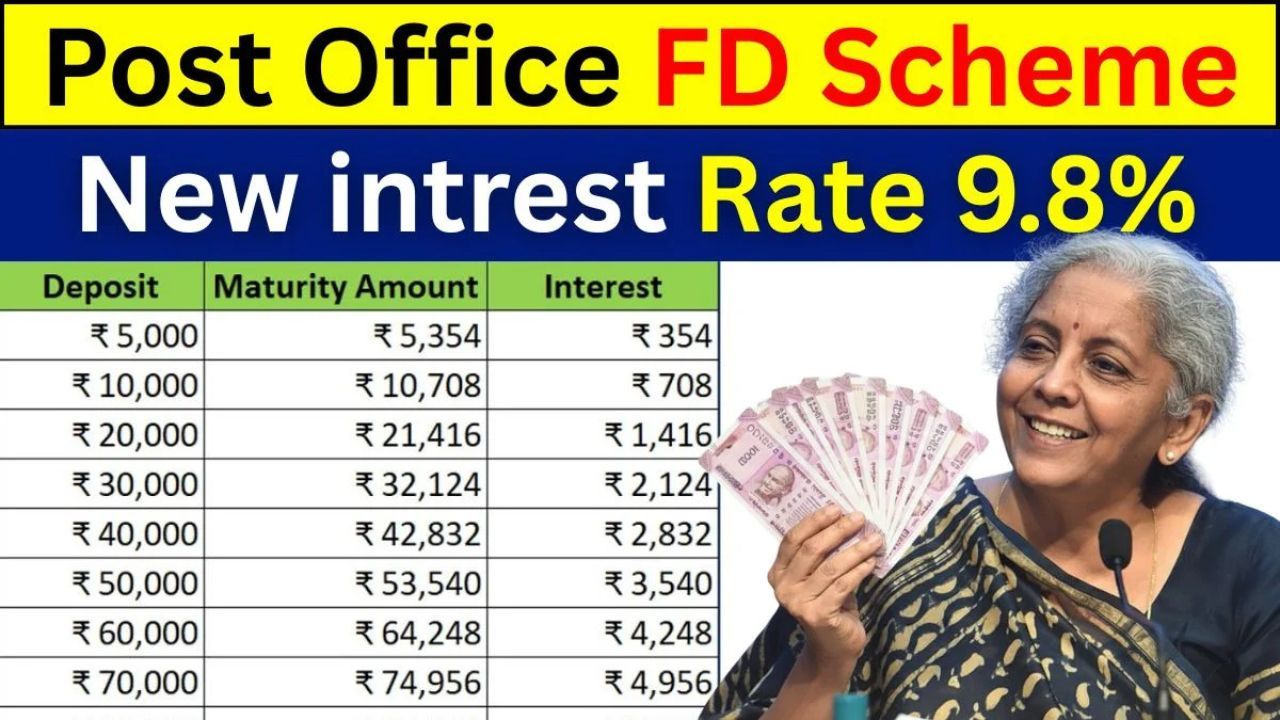

The scheme has provided for quarterly compounding of interest that offers higher maturity value as compared to simple annual interest. At the time of maturity, the investor gets the principal amount with the accumulated interest.

The amount of returns depends on certain factors: how much the investor deposited at the time of investment, the tenure for which investment was made, and the interest rate prevailing at the time of opening of the FD.

Step-by-Step Guide to Using the Calculator

Here are the steps to calculate the maturity amount of your investments in 2025:

- Select the tenure: Choose between 1, 2, 3, or 5 years.

- Enter the deposit amount: You may invest anything starting from ₹1,000 in multiples of ₹100.

- Confirm the interest rate: It applies to the tenure chosen.

- Apply quarterly compounding: It works automatically to give an accurate result.

- View maturity amount: See immediately how your investment will grow by the end of the period you chose.

For example, if you had deposited ₹50,000 in a 5-year TD at 7.5%, the maturity amount would be around ₹71,781.

Investment Guide for Beginners

It is easy to open a Post Office TD in any branch by filling in a simple form and providing KYC documents like Aadhaar and PAN. Investors can open accounts either individually or jointly. The minimum deposit is ₹1,000, and there is no maximum limit; this allows it to serve individual small savers as well as very large investors. One cannot withdraw money until after six months after which premature withdrawals are possible with reduced interest.

Benefits of Post Office TD in 2025

- Safety: Fully backed by the Government of India.

- Flexibility: Multiple tenure options to suit your short-term and long-term goals.

- Tax Savings: 5-year deposits are eligible for deductions under Section 80C.

- Accessible Nationalwide: Can be opened anywhere in India.

Conclusion

The Post Office Term Deposit Scheme 2025 remains a safe and rewarding option for somebody in need of guaranteed returns. With an easy step-by-step calculator and an easy investment process, one can plan their savings. Whether it is ₹10,000 or ₹1,00,000, the scheme assures stability, assurance from the government, and definite grow