When it comes to fixed deposits (FDs), there are generally some accepted few categories of stable and secured returns. Holding that reputation for credibility maintained by government assurance is an advantage that Post Office FDs enjoy.

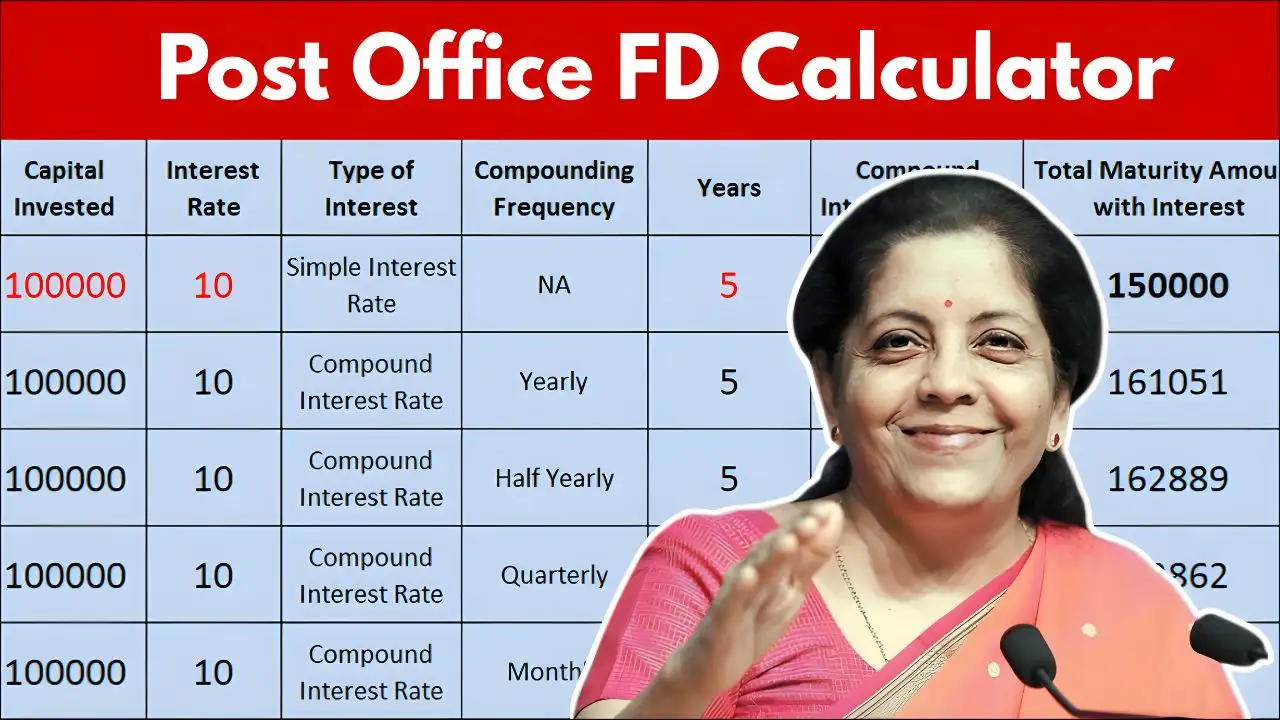

To further ease the financial planning season for their investors, a practical tool known as the Post Office FD Calculator 2025 is put before them to gauge possible returns to plan their investments as duly as possible.

Understanding Post Office Fixed Deposits

Post Office FDs are long-term investment products whereby individuals put in a fixed amount for a specified amount of time. These deposits ensure guaranteed rates of returns and give the security of government backing. The interest rate on these FDs remains competitive and is reviewed from time to time so that it suits those conservative investors who rank security over high-risk gains.

How an FD Calculator Works

The Post Office FD Calculator 2025 is an easy-to-use, powerful online tool that helps the investor calculate his expected returns on deposit amount, tenure, interest rates prevailing. Here, the user enters the principal amount to be invested, chooses the tenure period, and immediately sees the maturity amount computed along with the interest earned. This way, no manual calculations are ever necessary, and investors can make very quick decisions.

Uses of FD Calculator

FD calculator helps in various ways in investment. One, it clarifies the investment growth over a period and aids individuals in financial planning. Two, it allows side-by-side comparisons of different tenure options and interest payout alternatives, like cumulative interest or interest paid quarterly, so investors can take their pick based on specific requirements. Third, it aids investors in finding their way in meeting short-term or long-term financial goals, such as children’s education fees, retirement planning, or festival expenditures.

Planning Your Investments Smartly

A smart investment planning process must have precise knowledge of schemes available as well as a precise projection of returns. The FD calculator allows the investor to vary the amount and tenure to find the right option. Considering factors like tax implications, interest payout, and tenure, investors can ultimately increase their savings and maximize returns with minimal risk.

Conclusion

The 2025 Post Office FD Calculator is much more than a mere calculating tool: it helps investors make wiser investment choices. In fact, using it, the investor can design his FDs with utmost certainty of returns and accordingly plan his savings for eventual expenditure.

In the times of market uncertainties, this investment avenue is secure and highly rewarding: post office FDs are government-backed securities, and with good planning through the FD calculator, you still cannot go wrong.