Gold has always been important in Indian scores of homes- for cultural significance and as a money-making opportunity for easy liquidity. By 2025, with increasing volatility in markets and the panic of inflation looming large, many investors are opting for gold as a shelter of sorts.

Keeping in consideration the culture prevailing, the State Bank of India has introduced facilities of SBI Gold SIP – a systematic investment plan wherein small amounts can be invested regularly in gold so they can be grown over time.

What Exactly is an SBI Gold SIP and How Does It Work?

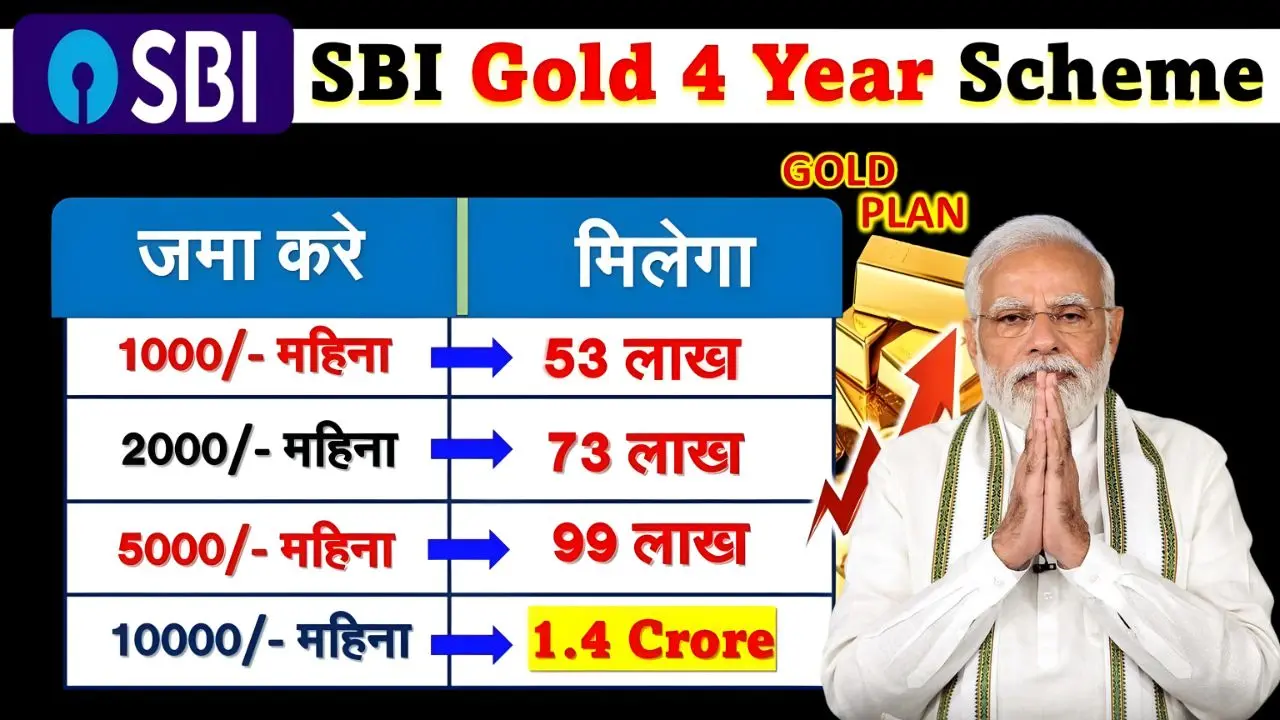

The SBI Gold SIP is an investment methodology that helps inculcate the spirit of discipline among individuals who want to enjoy the long-term appreciation of gold without having to physically purchase the same. The investments are made directly in gold ETFs or in gold mutual funds managed by SBI. Investors can begin with just ₹500 per month, and those slow and steady contributions build up to a huge corpus in due course.

Based on the principle of compounding, any returns received from each monthly payment are reinvested, accordingly growing at a steady rate. The SBI Gold SIP Calculator comes handy in checking the potential maturity amount of your investments depending on your monthly contribution, investment period, and expected return rate.

Benefits of Investing In SBI Gold SIP 2025

Among various benefits, the SBI Gold SIP unlocks exposure to the precious metal without any concerns of storage or purity. It is a digital platform, thus allowing investors to keep track of performance and watch over their portfolios through any of the online channels offered by SBI. Furthermore, gold funds are regulated and transparent, giving them an additional layer of safety and reliability.

Gold, traditionally, has been a hedge for accelerating inflation and a falling currency. In times of economic uncertainty, it tends to be performing very well and hence has to be included in any diversified portfolio. Due to the availability of monthly investment, SBI Gold SIP allows investors to purchase gold at varying price points, thus offsetting market swings.

Long-Term Growth Potential

The love for consistency and time plays a major role in the success of a SIP in gold deposits. To cite an example, a monthly investment of ₹4,000 for 20 years with an average return of 10% could grow into over ₹80 lakh. Being market-linked and huge in such investments, gold has seen steady returns over the years and therefore is, in essence, a very safe long-term accumulation avenue.

Conclusion: A Golden Path to Financial Security

The SBI Gold SIP 2025 is the perfect investment choice for investors seeking a safe, convenient, and growth-oriented avenue. By placing small amounts at regular intervals, you can reap the benefits of gold’s stability compounded over time. Whether for retirement, kids’ education, or any other financial goals, SBI Gold SIP stands as a safe and smart way to grow wealth with confidence.